Following are the Candlestick Pattern with Images.

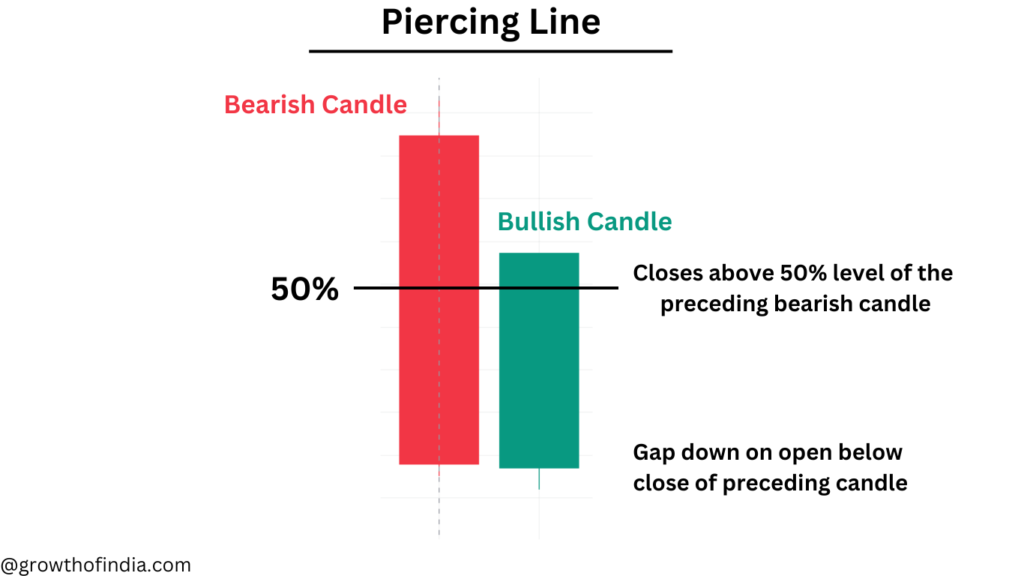

1. What is the Piercing line?

A piercing pattern is a two-day candlestick formation that signals a potential short-term reversal from a downtrend to an uptrend. It consists of a first-day candlestick that opens near its high, closes near its low, and has an average or larger trading range.

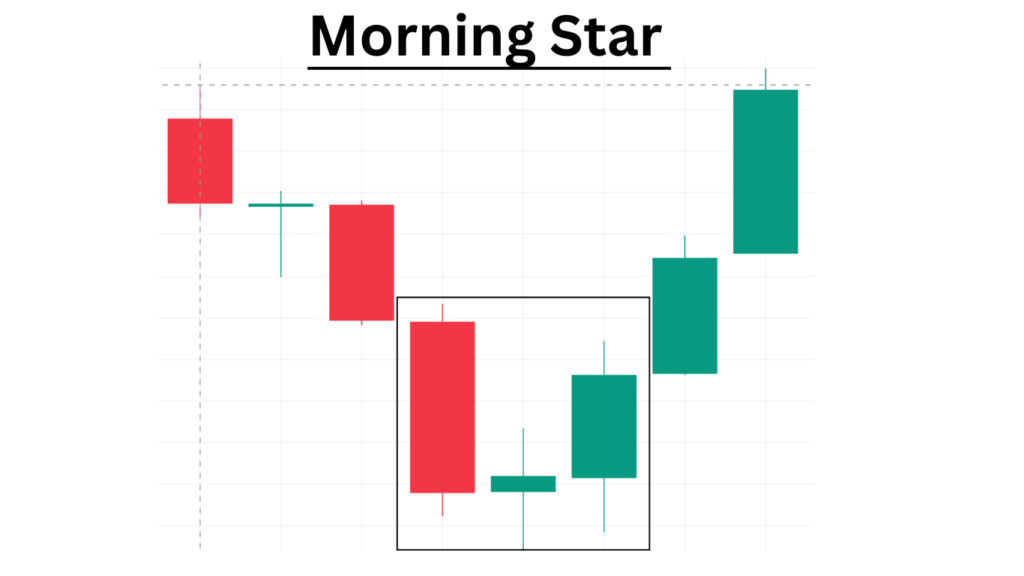

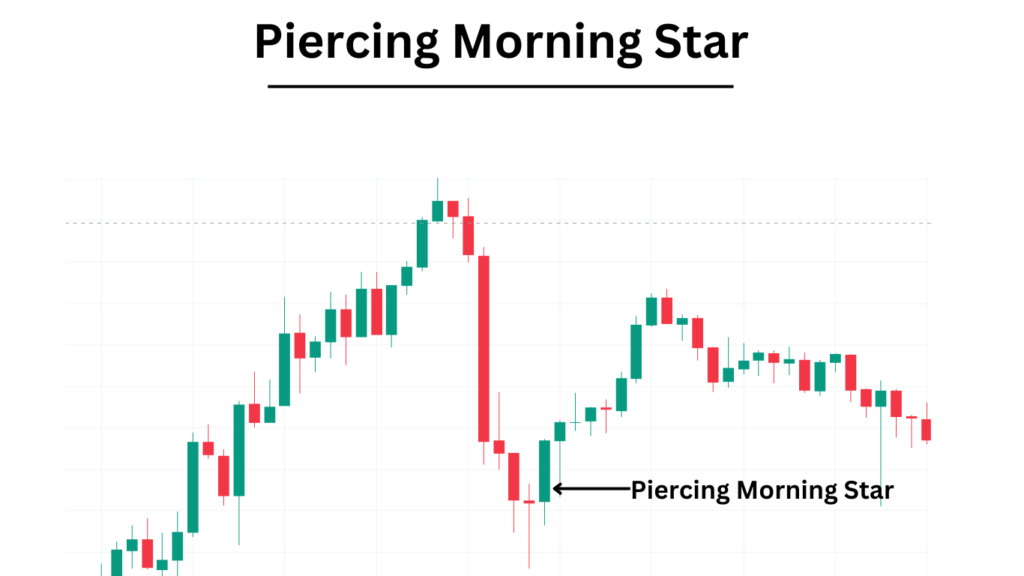

2. What is the morning star?

A morning star is a visual pattern of three candlesticks read as bullish signs by technical analysts. A morning star forms a downward trend and indicates an upward climb’s start. It is a sign that the trend is going to reverse.

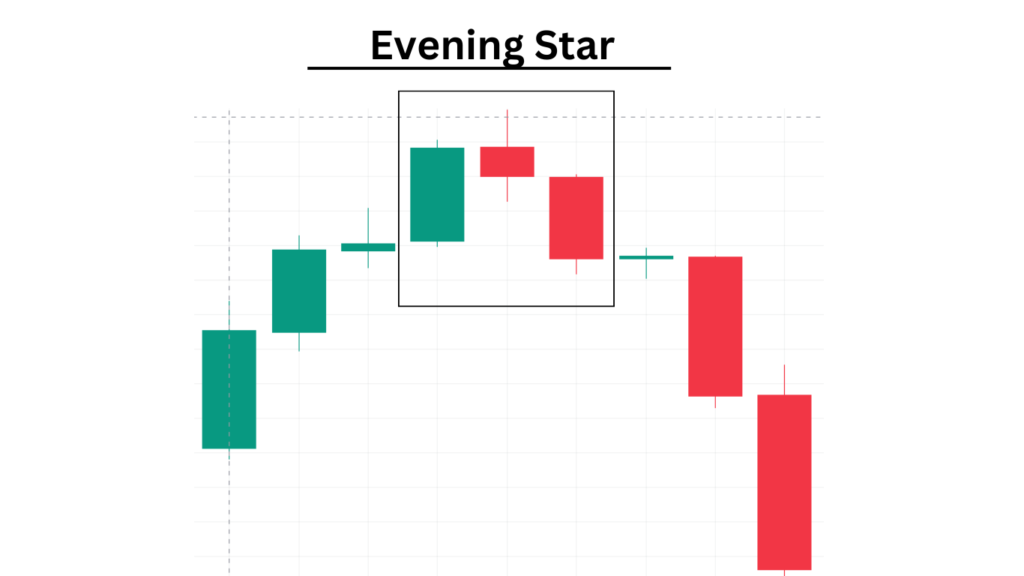

3. What is the Evening star?

This is a candlestick pattern that appears at the end of the uptrend and indicates that a downtrend is going to start. It is a bearish candlestick pattern comprising three candles: a large bullish candlestick, a small-bodied candle, and a bearish candlestick.

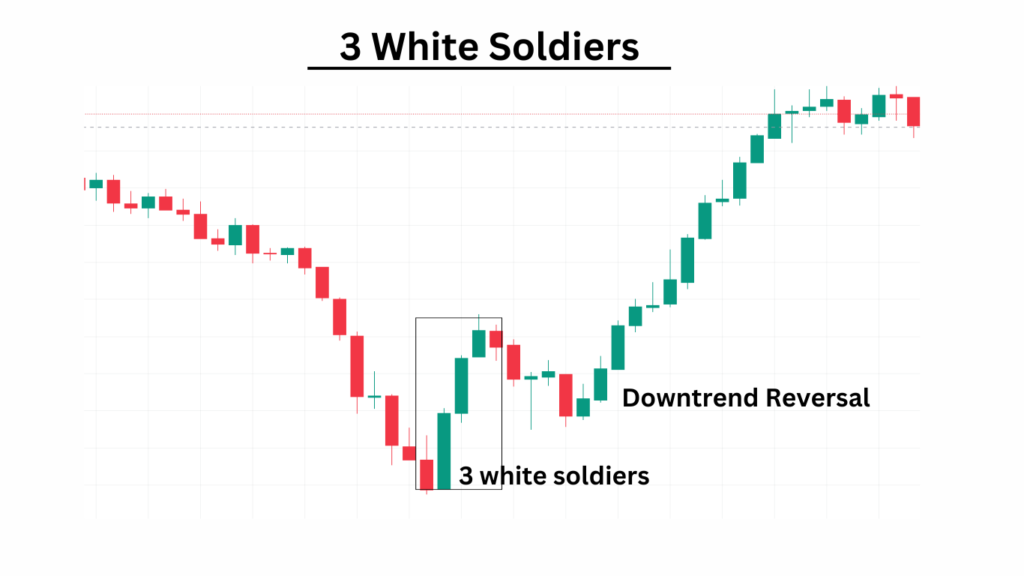

4. What are 3 white soldiers?

These are bullish candlestick patterns that are used to predict that the trend is going to reverse like if the trend is a downtrend in the pricing chart it will reverse. The pattern consists of three consecutive long-bodied candlesticks that open within the previous candle’s real body and are close and exceed the previous candle’ S high. The shadow of these candlesticks should be small.

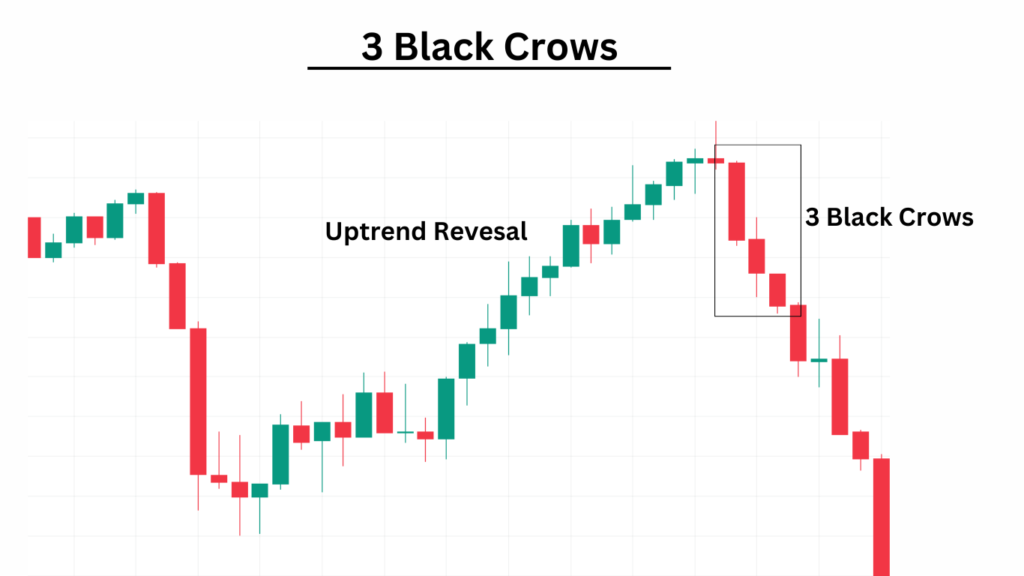

5. What are 3 black crows?

These indicate a bearish candlestick pattern that indicates the reversal of an uptrend. Candlestick charts show the opening, high, low, and closing prices of a particular security. The white and green candlesticks are high-moving stocks whereas the Red and black candlesticks are low-moving stocks.

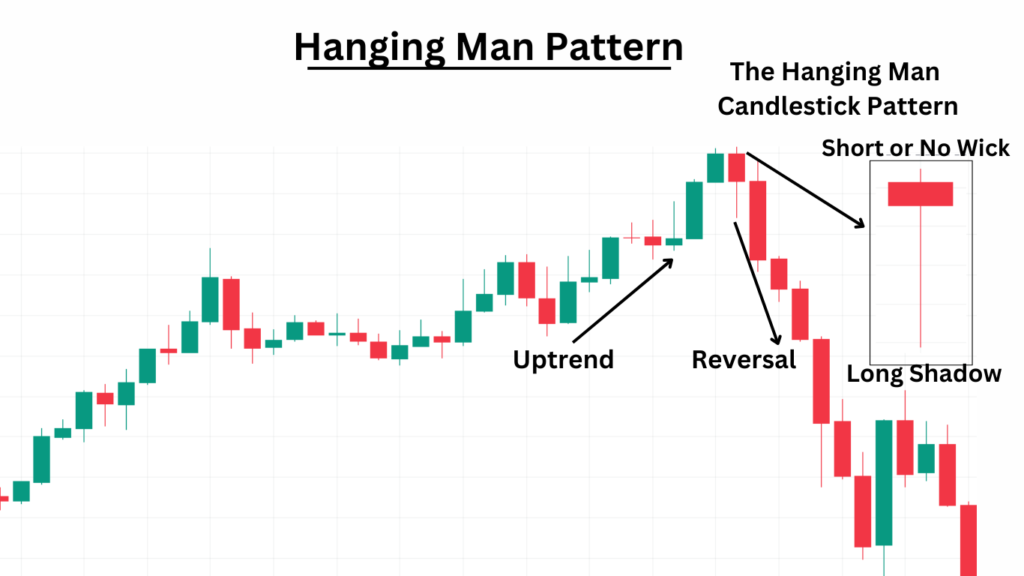

6. What is the Hanging Man pattern?

A hanging man candlestick occurs during an uptrend and warns that prices may start falling- The candle is composed of a small real body, a long lower shadow, upper shadow. The hanging man shows that selling interest is little or not starting to increase.

7. What is a Shooting Star?

This is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body. It appears after an uptrend. Said differently, a shooting star is a type of candlestick that forms when security opens, advances significantly, but then closes the day near the opening again.

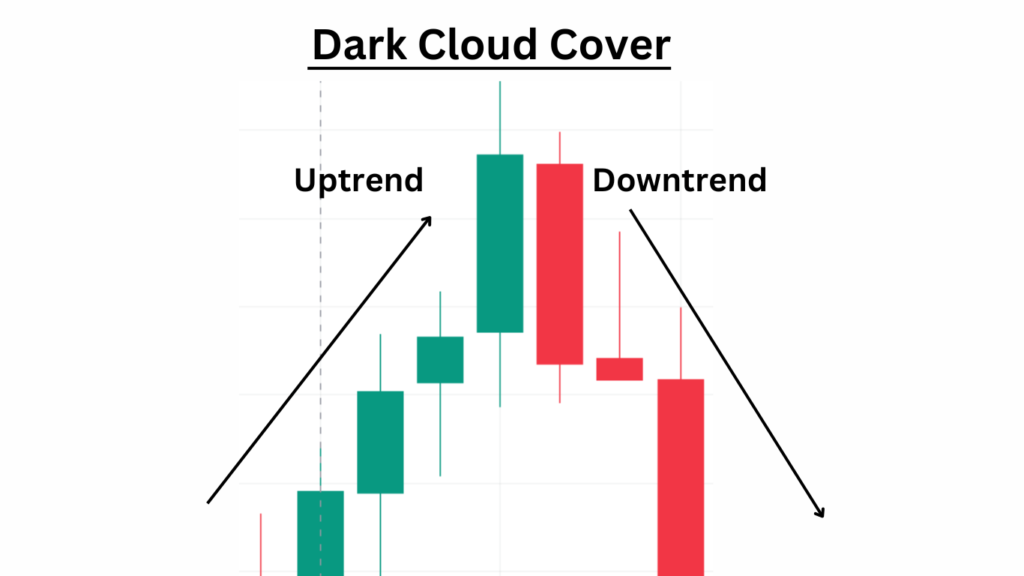

8. What is the Dark cloud cover?

Dark Cloud Cover is a bearish reversal candlestick pattern that occurs when a down candle (typically black or red) opens above the previous up candle’s close (typically white or green) and then closes below its midpoint. This pattern signals a shift in momentum from bullish to bearish. It consists of an up candle followed by a down candle, with traders anticipating further price declines on the next (third) candle.

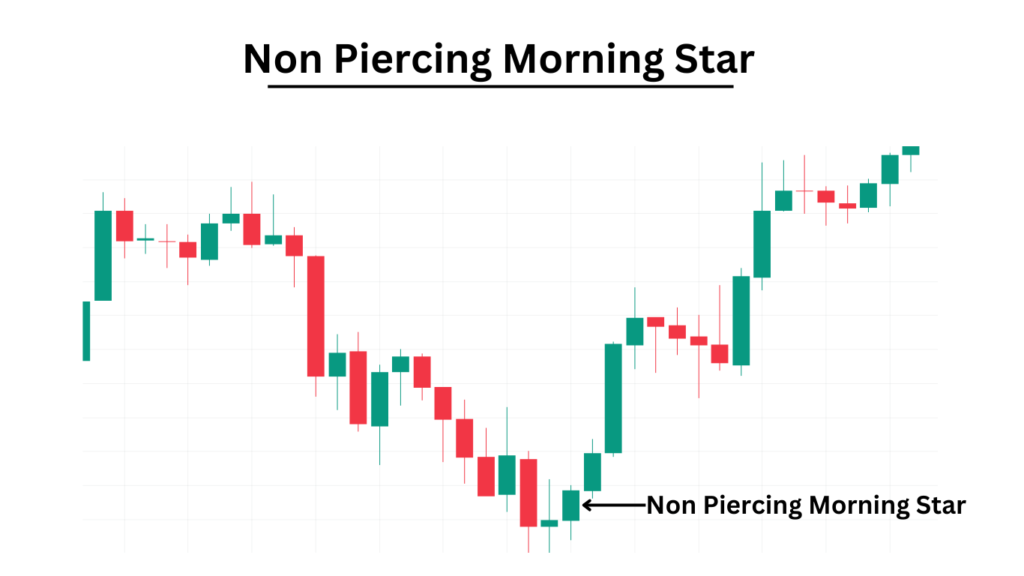

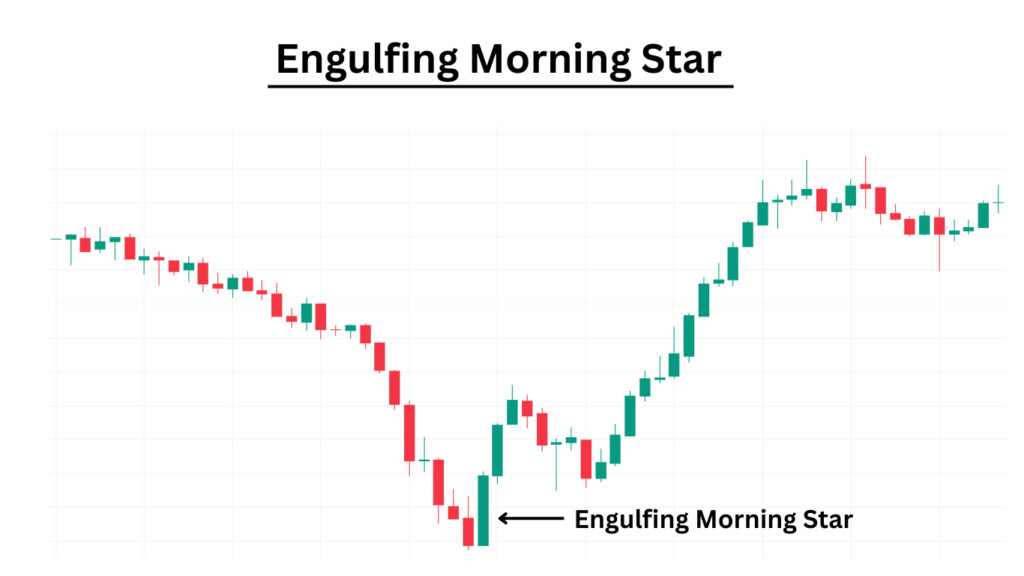

* What are the 3 kinds of morning star patterns in Candlestick Pattern?

1. Piercing Morning Star:

2. Non-Piercing Morning Star:

3. Engulfing Morning Star:

The above information is only for educational purposes, we hope it is useful for you. For more related blogs follow us o growthofindia.com