1)What is Stop-Loss?

Ans: Stop Loss can be defined as an advanced order to sell a stock/Trading instrument when it reaches a particular price point. It is used to limit losses in trading. The concept can be used for both short-term and long-term trading. This is an automatic order that a trader places with the broker. Stop-Loss is also known as ‘Stop order’ or ‘Stop market order.’ By placing a stop-loss order, the trader instructs the broker to sell a stock/trading instrument when it reaches a pre-set price limit, where the trader’s initial trade prediction is proved wrong by the market.

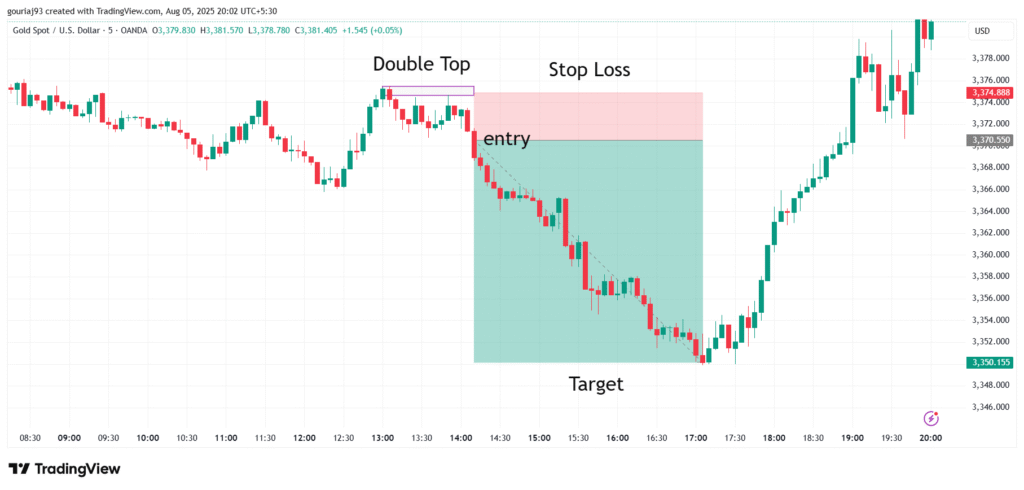

2)Where should we place Stop-Loss?

Ans: Stop-Loss should be placed in a logical place. It can be any point, pivot point, EMA, Fibonacci, EMA Price action, etc., which will vary based on the existing price action and breakout/breakdown scenario.

3)What should be the ideal Stop-Loss Range for Equity/Nifty/Bank Nifty/Forex/Crypto?

-For Equity: 0.5% (Good), 0.75% (OK), 1% (Big-Not Ideal, Opportunity)

-For Nifty: 50 Points (Good), 75 points (ok), 100 Points (Big- Not ideal, rare opportunity)

-For Bank Nifty: 100 Points (Good), 150 Points (Ok), 200 Points (Big-not ideal, rare opportunity)

-For Forex/Crypto: Stop Loss is not defined. Traders should follow the risk-reward ratio method. You should look for a logical stop-loss and accordingly take a 1:2 or 1:3 risk to reward ratio trade.

4)Four cases of Stop-Loss?

Case 1) Place logical Stop-Loss:

Suppose a stock breaks above the Rs 1000 resistance zone by gaining support from the Rs 998 level and closes above Rs 1000. In that case, we should set our stop-loss below Rs 998, not exactly at Rs 998, so that we have an advantage over the market makers and are protected if the stock comes to take other traders’ stop-loss. Our stop-loss might be at 996 or 996.5.

Case 2) No early exit after placing a logical stop-loss:

If the stock breaks the Rs. 1000 resistance zone, we enter when the candle closes above the resistance with a stop-loss of Rs. 996, as Rs. 998 was the last support, and the stock begins to move in our desired direction. Assume the stock reaches a level of Rs. 1005 and then drops to Rs. 999. Many traders may withdraw at this moment out of fear of losing additional money, but we should not do so unless we are proven wrong. Only when the 998 Rs. Support level is breached, will be proven wrong, hence we should hold the trades until our predetermined stop-loss is reached. From the Rs. 1000 level, the stock could reverse and meet our targets. Never exit before the stop-loss has been hit, which you decided as a logical Stop-Loss.

Case 3) Don’t shift your logical stop-loss/ Accept Stop-loss:

Early career traders tend to believe that the market cannot go against their trading strategy. Assume you entered a trade where the stock is breaching the Rs. 1000 resistance zone; you enter when the candle closes above the resistance zone with a stop-loss of Rs. 996, as Rs. 998 was the last support, and the stock begins to move in your goal direction. However, after a short period, the stock drops to Rs. 998, and as a beginner trader, you may become afraid and move your rational stop-loss to Rs. 995. When the stock reaches Rs. 996, you can raise your stop-loss to Rs. 993, which is eventually breached by the market. As a result, you end yourself losing more money than you planned. Never raise your stop-loss in the hopes of a market reversal; instead, stick to your first stop-loss.

Case 4) Trail your Stop-Loss:

Assume you enter at 100 rupees, with a stop-loss of 98 rupees and a target of 110 rupees. Now that the stock is advancing in your favor and has reached the Rs. 108 level, you should trail your stop-loss to breakeven, you can figure out based on your knowledge and experience. When you’ve reached 80% of your target, never let the market take your winnings or cause you to lose money.

We hope the above information is useful for you. We don’t give any trading tips. This is for educational purposes. for more related blogs follow us at growthofindia.com.