Learn Trading with the Growth of India for Free and Discover the Stock Market’s trending Topics

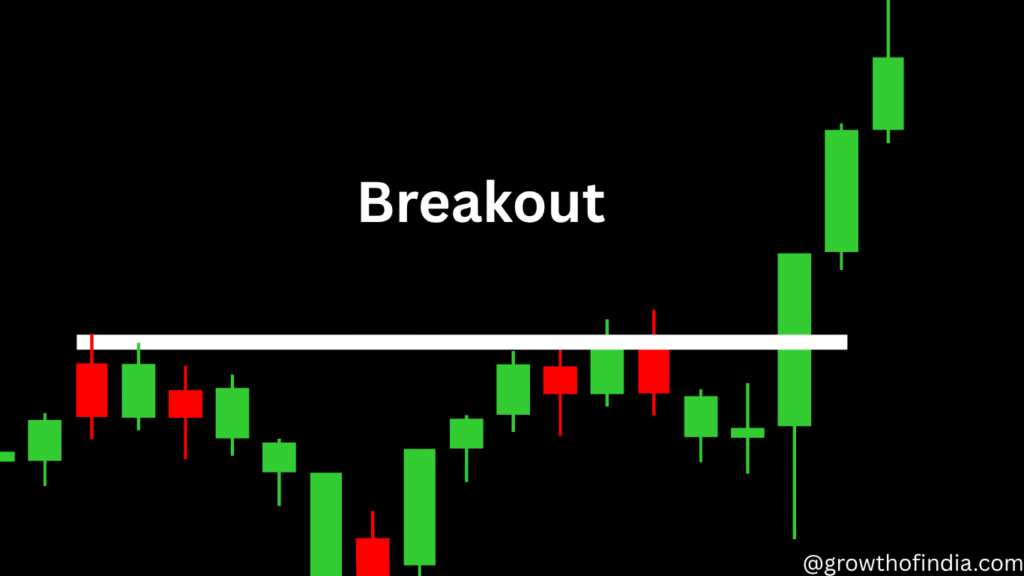

* Breakout secrets.

1. Multiple tests of the level

2. Consolidation or pullback

3. Less distance from the breakout point

*FAQ on Breakout?

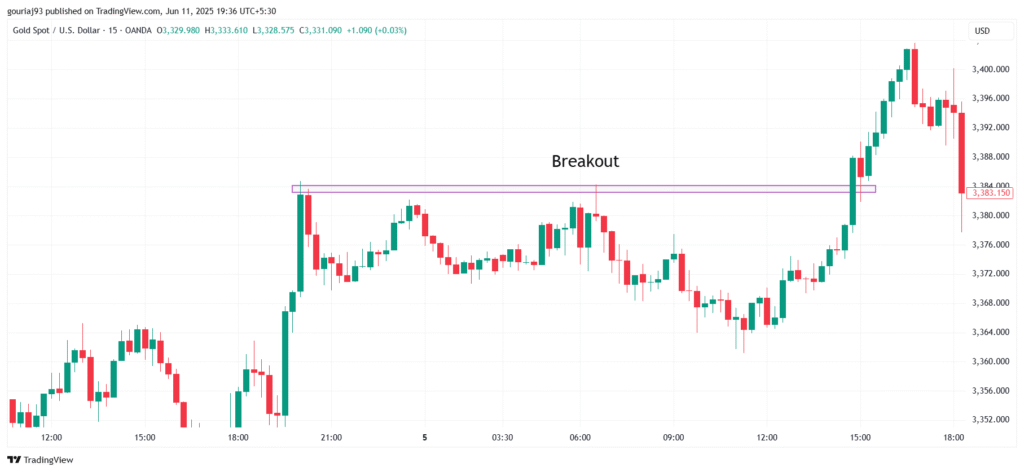

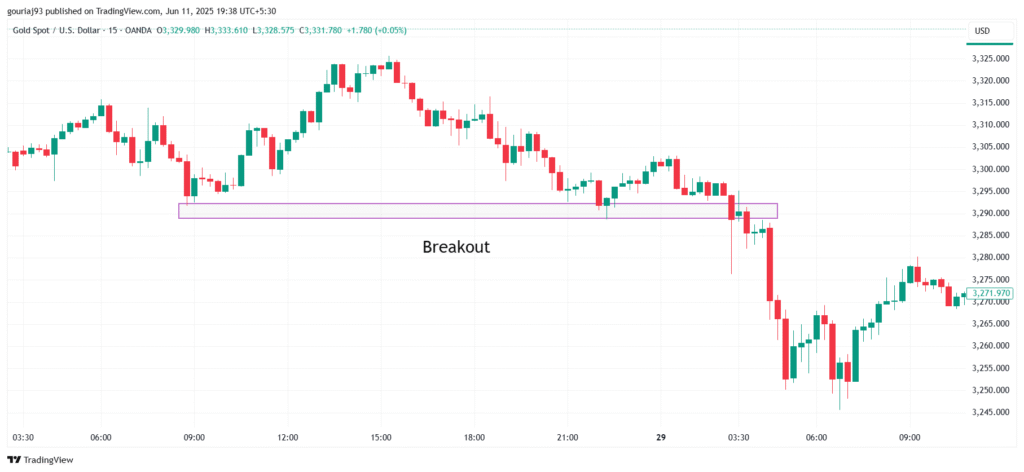

1. Which timeframe should be followed for breakout confirmation?

Ans- We should use a 15-minute timeframe to get a breakout confirmation on an intraday basis because 5 5-minute timeframe can give false signals at times, but with 15 15-minute timeframe, the price action confirmation gets stronger.

2. What is a breakout trade?

Ans- When a price attempts to break a specific level and has tested that level a couple of times, it breaks after a couple of attempts, initiating a trade opportunity.

3. What are the important breakout secrets?

Ans- 1) The Market should have tested the resistance or support from where we are expecting a breakout/breakdown, a couple of times.

2) It can be a minimum of 2 times, and the maximum can go up to 10-15 times.

3) The market should have consolidated for some time below or above the breakout/breakdown zone, as after consolidation, the momentum is stronger.

4) A pullback is also fine if consolidation is not there

5) The distance of price from the breakout/breakdown trade should be less, as it will help the price to sustain a longer momentum after the breakout/breakdown.

We hope the above information is useful for you. this is only for educational purposes; we don’t give any tips regarding the stock market. For more related blogs, follow us at growthofindia.com