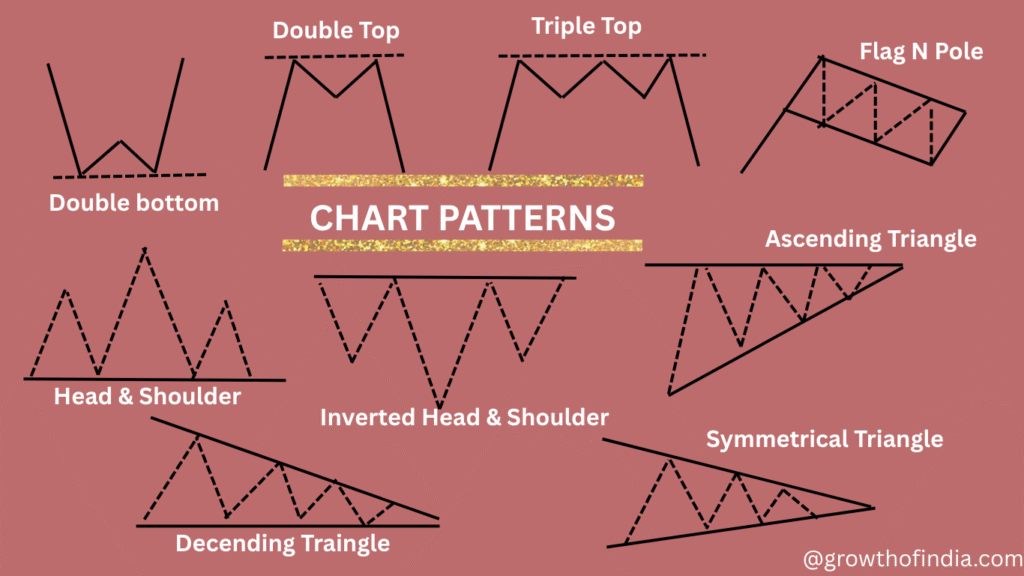

Learn Trading with the Growth of India for Free and Discover the Stock Market’s trending Topics. Chart patterns are visual formations created by the price movements of a stock or other financial asset, typically displayed on candlestick charts. Here’s a breakdown of common chart patterns in stock trading, grouped by type.

1) Double Top:

-Double Top: Price hits resistance twice – bearish reversal. (looks like “M”)

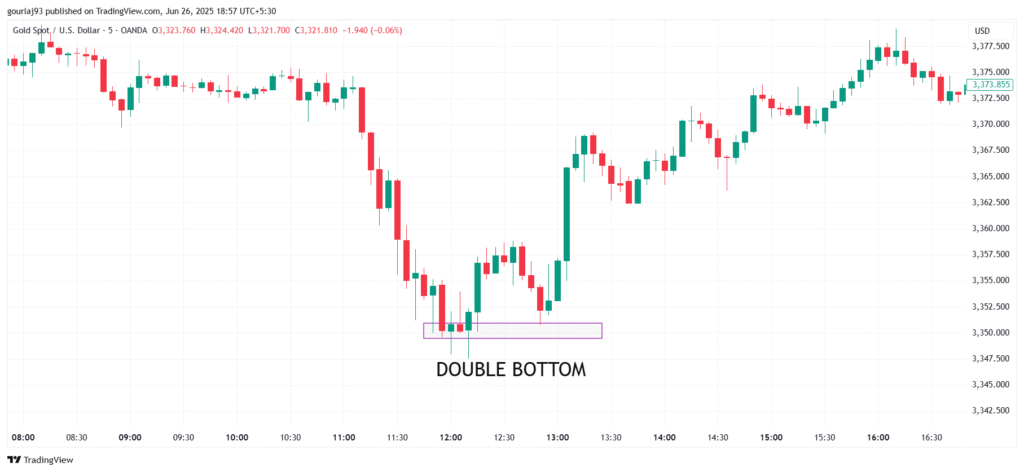

Double Bottom:

-Double Bottom: Price hits support twice – bullish reversal. (looks like “W”)

2) Triple Top / Triple Bottom

-Like the double versions, but with three touches.

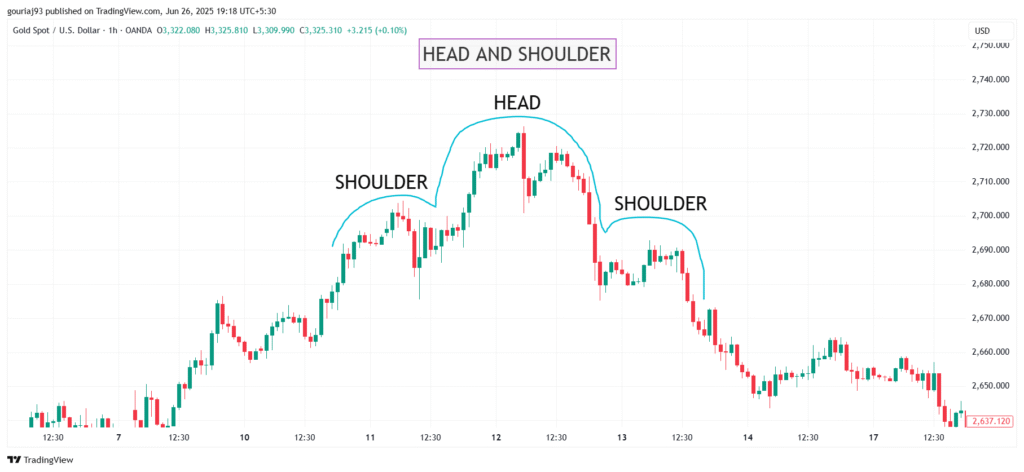

3) Head and Shoulders

-The market forms a head and shoulder pattern, which means the market is taking a reversal from Bullish to Bearish.

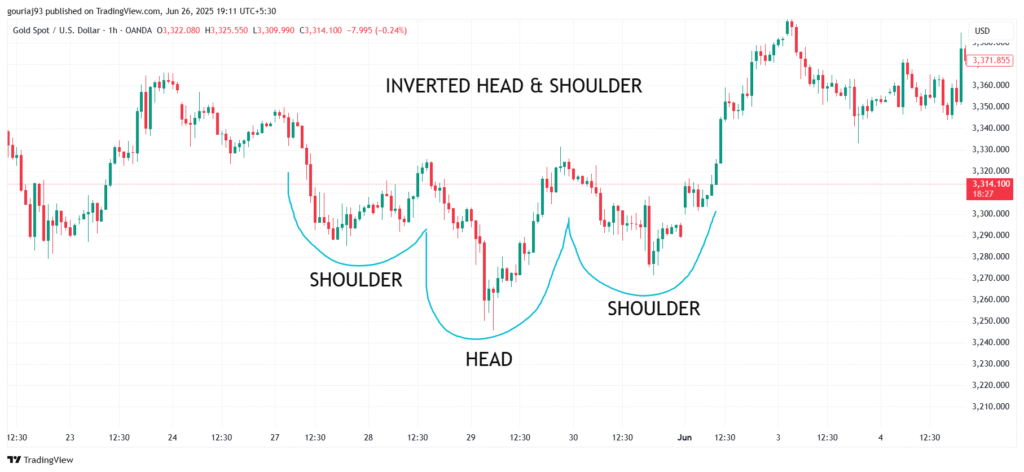

4) Inverted Head and Shoulders

-The market forms an inverted Head and Shoulders, which means the market is taking a reversal from Bearish to Bullish.

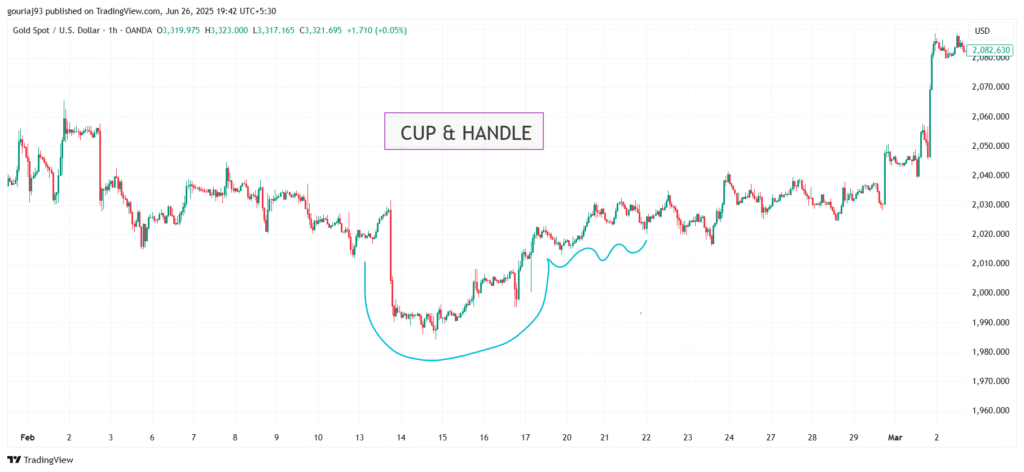

5) Cup and Handle

-It is a pattern that looks like a cup. price goes down and makes a consolidation, and again goes up, forming a cup pattern.

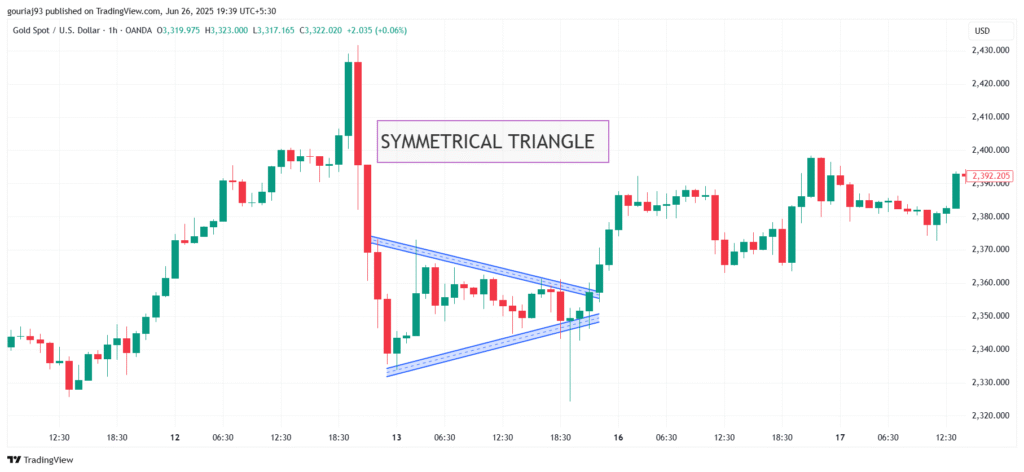

6) Triangles

*Ascending Triangle: Bullish, flat resistance + rising support.

*Descending Triangle: Bearish, flat support + falling resistance.

*Symmetrical Triangle: Neutral, price could break either way.

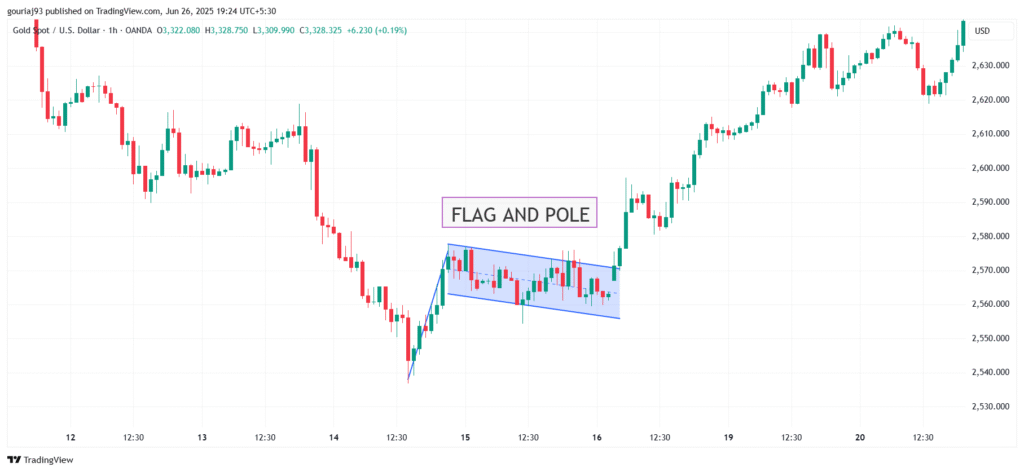

7) Flags n Pole Pattern

-It appears after a strong price move and looks like a Flag.

📈 Other Notable Chart Patterns

Wedges

Rising Wedge: Bearish, price moves up in a narrowing range.

Falling Wedge: Bullish, price moves down in a narrowing range.

⚠️ Key Tips for Using Chart Patterns

Use with indicators: RSI, MACD, and moving averages can help confirm patterns.

False breakouts: Be cautious — always set stop-losses.

Time frame matters: Patterns on longer time frames (daily/weekly) are more reliable.

The above information is provided for educational purposes only. We hope you liked it., For more related blogs follow us @growthofindia.com