Market Structure:

In trading, market structure refers to the overall framework of price movements on a chart, helping traders understand trends, key levels, and potential future price movements. It consists of several key elements:

* Trends (Directional Movement)

- Uptrend: Higher highs (HH) and higher lows (HL) indicate a bullish market.

- Downtrend: Lower highs (LH) and lower lows (LL) signal a bearish market.

- Sideways (Range-bound): Price moves within a horizontal range without a clear direction.

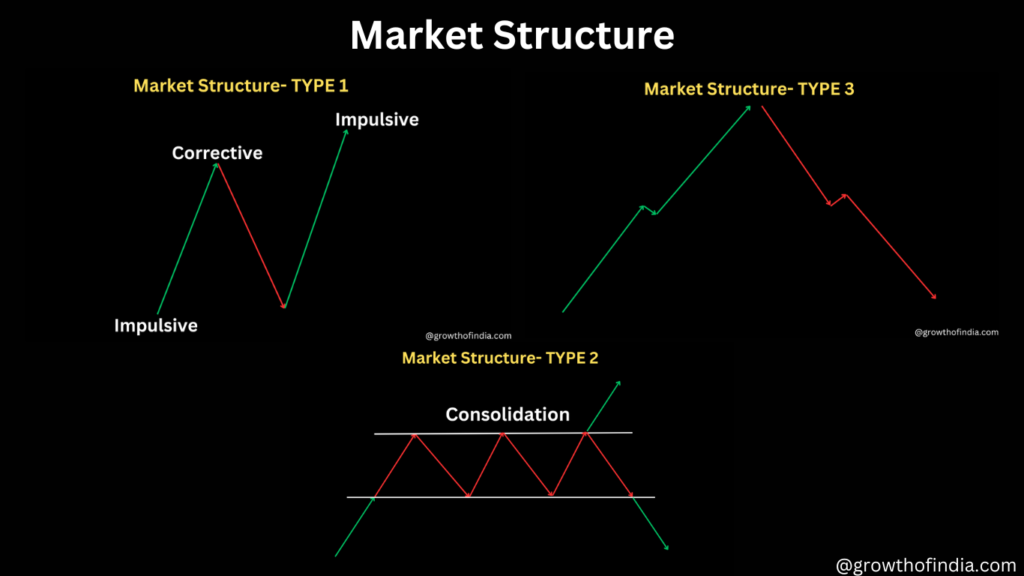

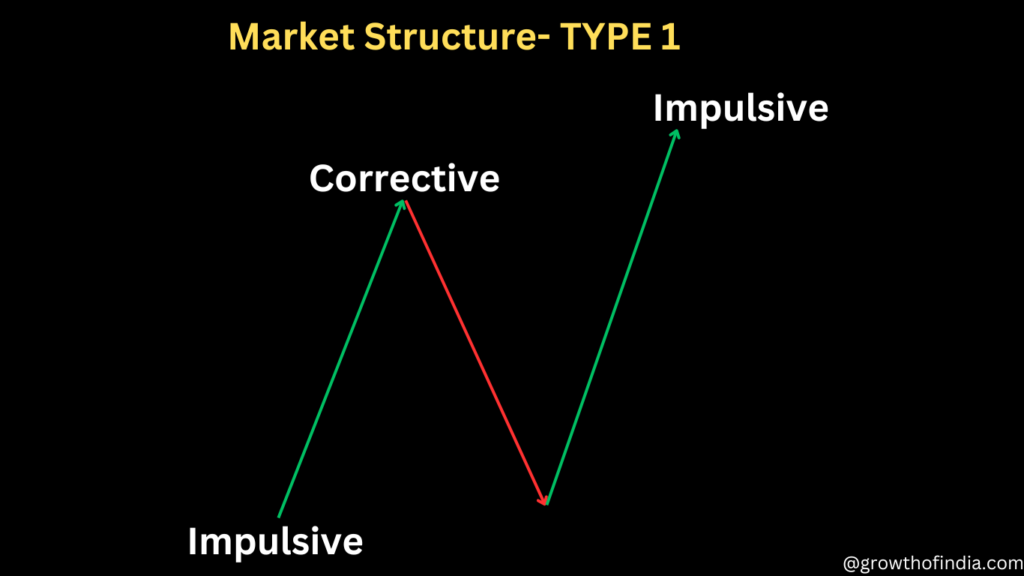

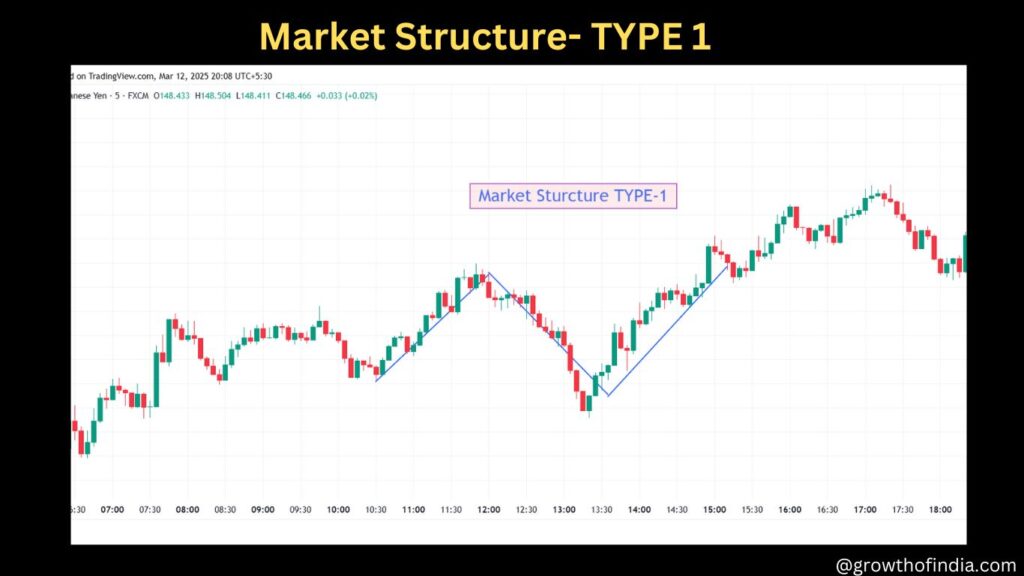

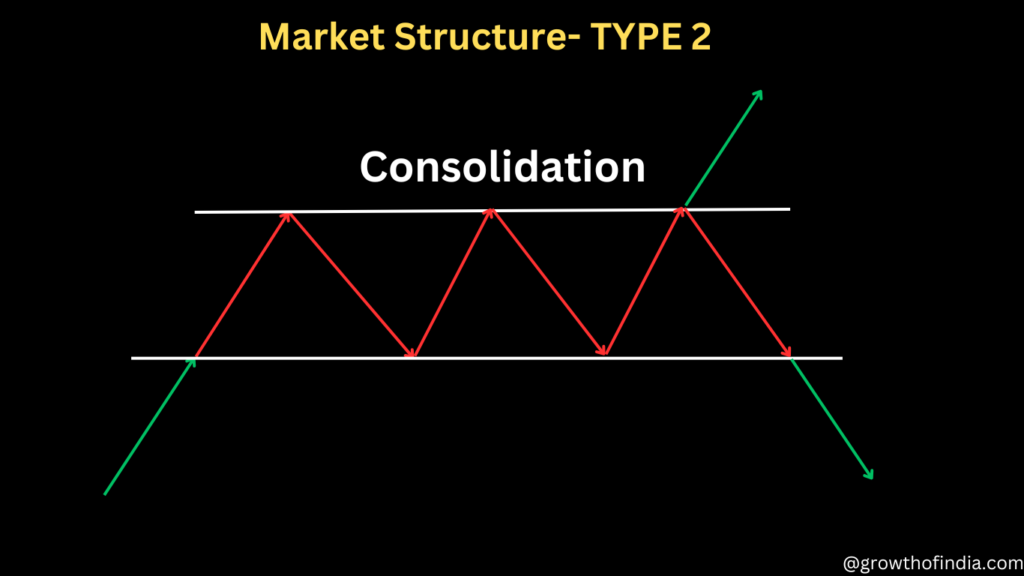

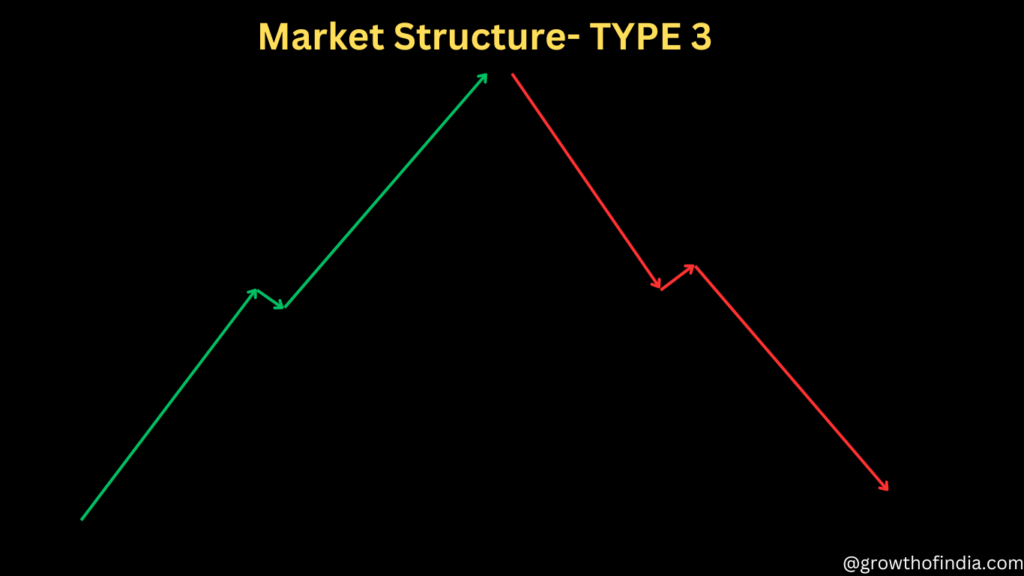

Types of Market Structure with charts:

In this type, the Market goes up, takes a pullback, and again goes up, forming an “N” shape pattern.

In this Type, the Market goes sideways for 3 to 4 hours forming a consolidation and give an upward or downward break.

In this Type of Market Structure, the market goes upward for a long time, forming an Uptrend or downward, forming a Downtrend.

The above information is only for educational purposes; we don’t give tips on Trading, We hope you like the above information For more related blogs like this, follow us on growthofindia.com