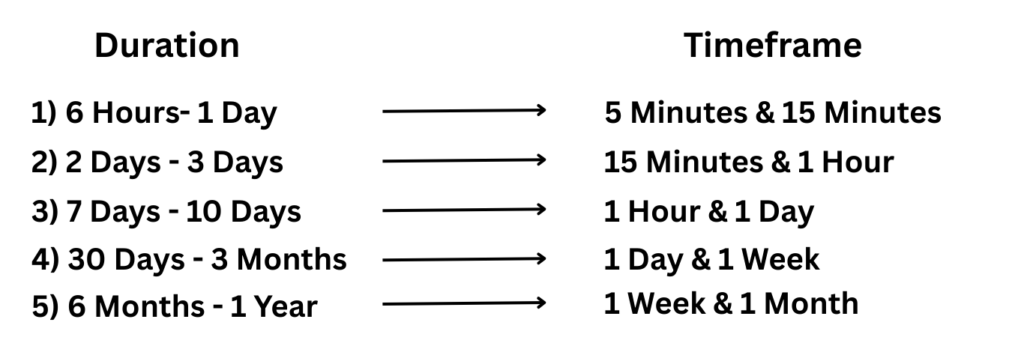

*Multiple timeframes analysis in trading when and how to watch:

FAQ’S on Multiple Timeframe Analysis in Trading.

1) Which timeframe is the most important one that we should look at?

Answer= 5 Minutes, 15 Minutes, 30 Minutes, 1Hour, 4Hours, 1Day, 1Week, 1Month.

2) What are the styles of trading, and which time frames can we look for them?

Answer= Intraday (one day)

Swing (multi-day)

Investing (Long-term)

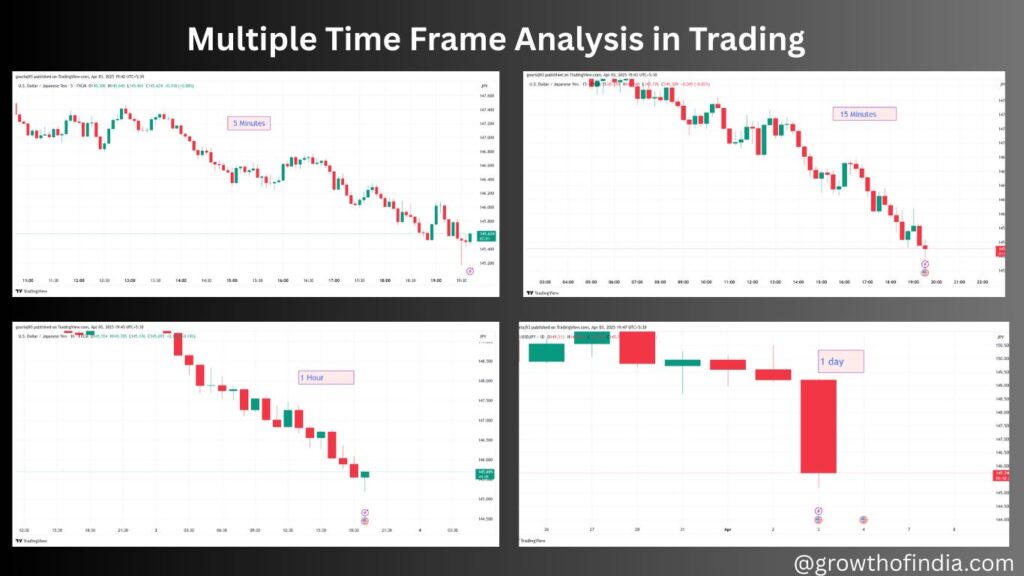

3) Why can’t we trade intraday on a more oversized time frame?

Answer= Because we need more data for intraday trading, for example, 1 Hour candle= twelve 5-minute candles. Therefore, we cannot make decisions for intraday using bigger timeframe candles.

4) Which time frame should I look at if I am an intraday trader?

Answer= 5 Minutes and 15 Minutes.

5) Which timeframe should I look at if I want to trade for 3 days?

Answer = 15 Minutes and 1 hour

6) Which timeframe should I look at if I want to trade for 7 days to 10 days?

Answer = 1 Hour and 1 Day

7) Which timeframe should I look at if I want to trade for 30 Days to 3 Months?

Answer = 1 Day and 1 week

8) Which timeframe should I look at if I want to trade for 6 Months to 1 year?

Answer = 1 week and 1 Month

9) Which timeframe should I look at while trading Forex and Commodities?

Answer = 1 Hour, 4 hours, 1 day, 1 week

10) Which timeframe is best for drawing horizontal lines for intraday?

Answer = The 1-hour chart time frame for drawing levels and then open smaller timeframes like 5 minutes and 15 minutes for taking entry.

This information is only for educational purposes; we don’t give any trading tips. We hope you like the above information For more such blogs, follow us on growthofindia.com